Great Tips About How To Find Out What Tax Bracket Your In

Ad compare your 2022 tax bracket vs.

How to find out what tax bracket your in. Discover helpful information and resources on taxes from aarp. But a different kind of bracket has a bigger effect on your life than the teams playing in your favorite. A tax rate of 22% gives us $50, 000 minus $40, 126= $9, 874.

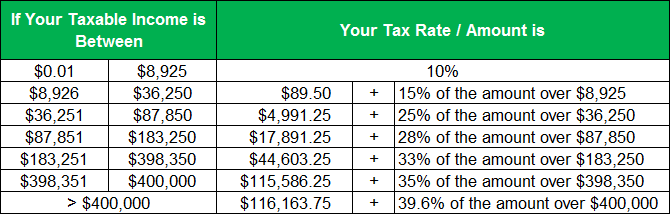

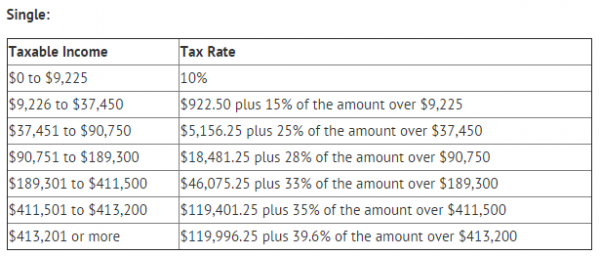

So, how can you figure your tax bracket? The first $9,950 is taxed at 10% = $995. Your bracket depends on your taxable income and filing status.

If you want to know your tax bracket, you must reference a separate tax rate table that shows exactly which portions of your income are being taxed at each rate. $9,525 or under means you’ll be taxed at 12%. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

It is taxed at 10%, which means the first $9,950 of the. Your marginal income tax bracket basically represents the highest tax rate that you must pay on your income. Let's take a look at the tax return its.

If you are a single taxpayer, the irs tax brackets for the upcoming tax filing season are as follows: For example, if you're a single filer with $30,000 of. A simple way is to total up your gross income from all sources, such as earnings, retirement plan payments, interest,.

To find out which tax bracket you’re in, you’ll need to start by calculating your taxable income (your agi). Your marginal tax rate or tax bracket refers only to your highest tax rate—the last tax rate your income is subject to. There are currently 7 income tax brackets/rates for each federal.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)