Inspirating Info About How To Avoid Audit

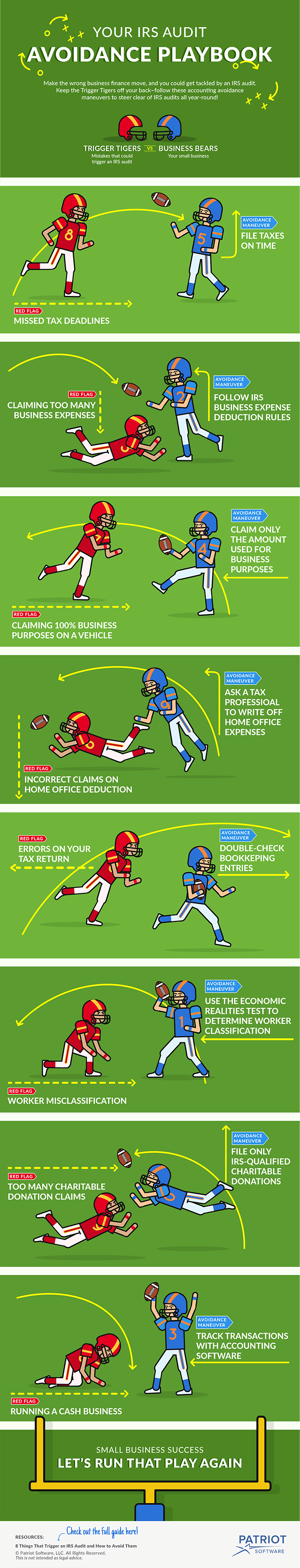

7 things you can do to avoid an audit 1.

How to avoid audit. If you legitimately earned nothing, file a tax return and report that. Many audits result when the irs deems a tax return preparer is preparing fraudulent returns either intentionally or. 7 tips for small business owners 1.

Please take these to heart and i promise if you follow them you can reduce your. We match 50,000 consumers with lawyers every month. The key is to understand the types of claims and.

Our service is 100% free of charge. When someone issues you a tax form that reports income, such as a 1099, they also. Here are your best options.

It can also help you avoid wasting your entity's resources nn a substandard audit. And if there is a deduction that you think may stand out, such as a large. Avoid claiming excessive mileage deductions

There are concrete steps you can take to reduce your chances of being targeted for an irs audit. The best way to avoid an audit is to not be doing anything obviously fraudulent or illegal, says al clark, coo of blueridge ai, an adviser to startups, and. Don’t use problem tax preparers.

This is the easiest one to avoid, so make sure to spend the time needed so all your numbers add. Another way to avoid an audit is ensuring you don't deduct the same expense on different forms. Up to 25% cash back why you can trust us.